WHAT WE DO

Imagineering Real Estate, One Property At A Time.

At Valiance Capital, we transform undervalued multifamily and student housing real estate into modern, branded assets in the most desirable locations and markets in the US.

Our mission is to provide access to institutional-grade real estate, tax-efficient passive income, and long-term wealth for our partners while creating long-term value for our communities. We provide access to the most attractive investment opportunities in high-barrier-to-entry markets. We execute upscale, deep value-added renovations and new developments. We strive to deliver unrivaled hospitality-driven management to our communities.

Over the past 15 years, we have engineered a vertically integrated approach across multiple disciplines to corner our niche markets, reflected in our proven track record and our reputation in the markets we specialize in.

HOW WE DO IT

Deft Decisions. Prudent Process.

To put it plainly, we are the best because we strive to add value at every step of the investment process, no matter how seemingly insignificant the opportunity. This approach allows for us to optimize returns, without adding more risks, and ultimately producing favorable risk-adjusted results to our ecosystem of stakeholders, resulting in access to more opportunities. This flywheel effect is what gives us access to the best opportunities. Our approach focuses on the long-term, creating value in our properties and communities over the long haul. This is what makes our properties so attractive to our residents, and in the end, what’s good for our residents is good for our business.

OUR RESULTS

Sustainable Growth. Demonstrated Results.

Since our first acquisition in 2010, our portfolio of assets has grown from a single duplex in Berkeley, CA, into a multifamily and student housing real estate portfolio worth over $300 million. Over the last decade, we have outperformed the market by an average of 17.5% every year, growing explosively from just 2 units in 2010 to over 900 beds and growing. With over $300 million in principal transactions executed and an average net annualized return of 25.5% on disposed assets, we continue to invest in our platform to identify market dislocations to scale our growing portfolio and expand our impact on the community we invest in.

Assets Under Management

WHO WE ARE

Obsessively Driven. Relentlessly Determined.

At Valiance Capital, the unrelenting pursuit of perpetual prosperity guides our every waking moment. It’s what gets us out of bed in the morning, and keeps us in the office long after the city has gone to sleep. We’re a team of go-getters—driven and ambitious, entrepreneurial in nature—that understand that the only way to get ahead in this world is through grit, an obsessive work ethic, and relentless persistence. Propelled by financial hardship in our early lives, we realized early on that true success is a marathon, not a sprint, so we’re in this for the long haul.

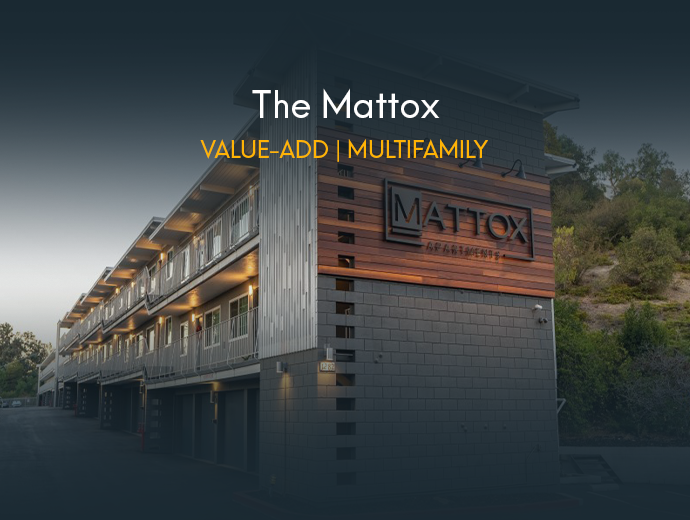

CASE STUDIES

The Prospect

Re-imagined and re-defined, Prospect is Valiance Capital’s flagship project that is revolutionizing what student housing can be.

With over 20,000 sf. of luxury living spaces and unrivaled hospitality and amenities, Prospect was transformed from a neglected student-housing property—with few tenants at the time of acquisition— into the premier, up-scale student co-living community within walking distance of UC Berkeley.

WE'RE ENDORSED

What Our Investors Are Saying

Valiance Capital is a private real estate development and investment firm specializing in student and multifamily housing.

Access the Highest-Quality Real Estate Investments

INVEST LIKE AN INSTITUTION

Valiance Capital

2425 Channing Way Suite B

PMB #820

Berkeley, CA 94704

investors@valiancecap.com

(510) 446-8525

©2025 Valiance Capital. All Rights Reserved.

Access the Highest-Quality

Real Estate Investments

Invest Like an Institution

©2025 Valiance Capital. All Rights Reserved.

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither Valiance Capital nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision. For our current Regulation A offering(s), no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth (excluding your primary residence, as described in Rule 501(a)(5)(i) of Regulation D). Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.