"America's #1 Best College"

"#1 US Public University Nationally"

"#1 Public and #4 Overall University"

"#2 Public University in the West"

"#2 Top Public School Nationally"

OUR STRATEGY

12 Years in the Making. 7-tier strategy generating 17-20%+ returns to 200+ investors.

SEVERE SUPPLY SCARCITY

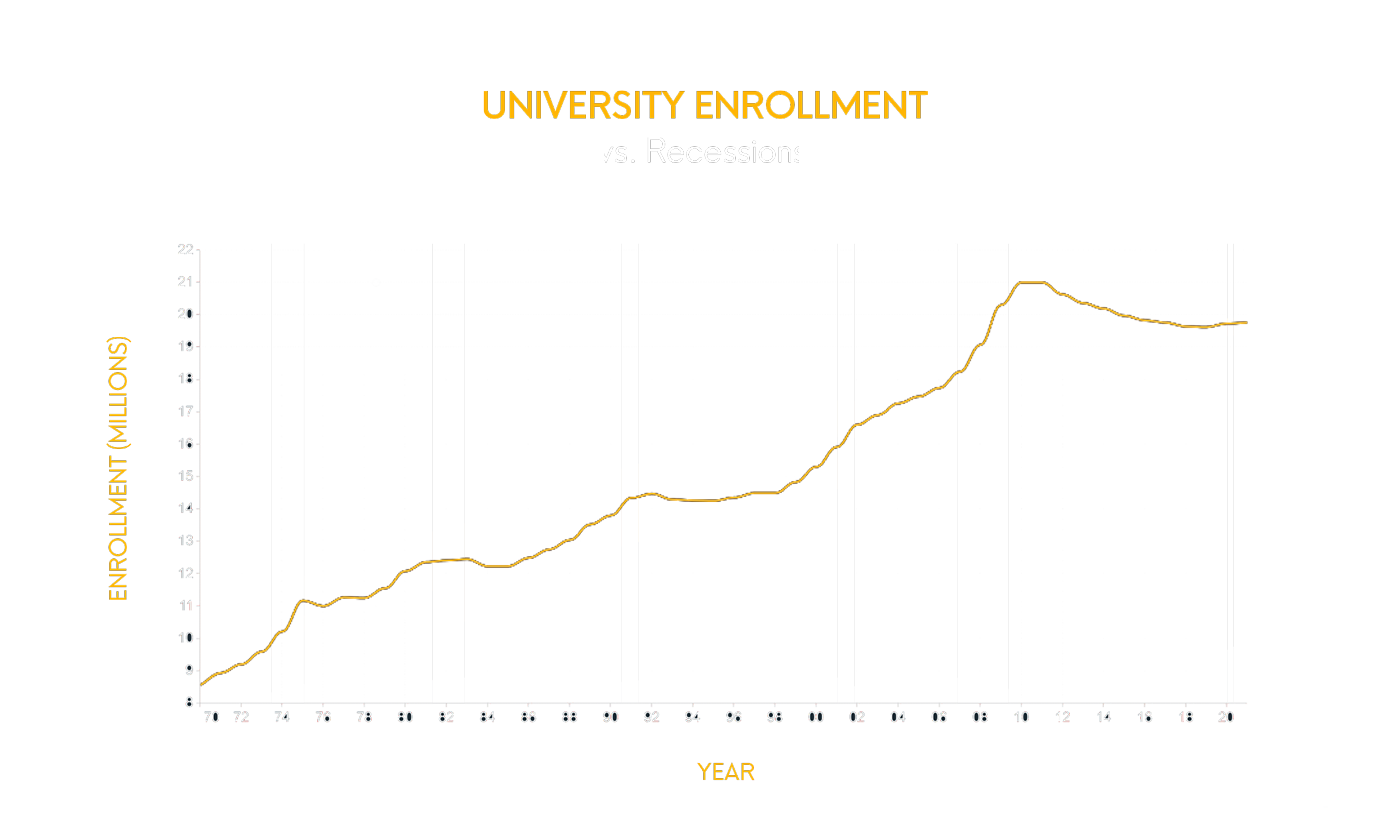

The student housing market in aggregate faces an inelastic demand that drastically outpaces supply, and nowhere is this more true than at UC Berkeley, where one of the nation's most severe housing shortages is ongoing.

To put things in perspective, UC Berkeley currently has under 9,000 beds for the entire student body of roughly 45,000. That means only one out of every five students has a university-provided bed — the lowest percentage of beds per student of any campus in the UC system.

Despite the University’s effort to add over 11,000 beds in the next 15+ years, at current enrollment projections, 75% of UC Berkeley students would still need to be housed outside of the University system.

REMARKABLE RENT GROWTH

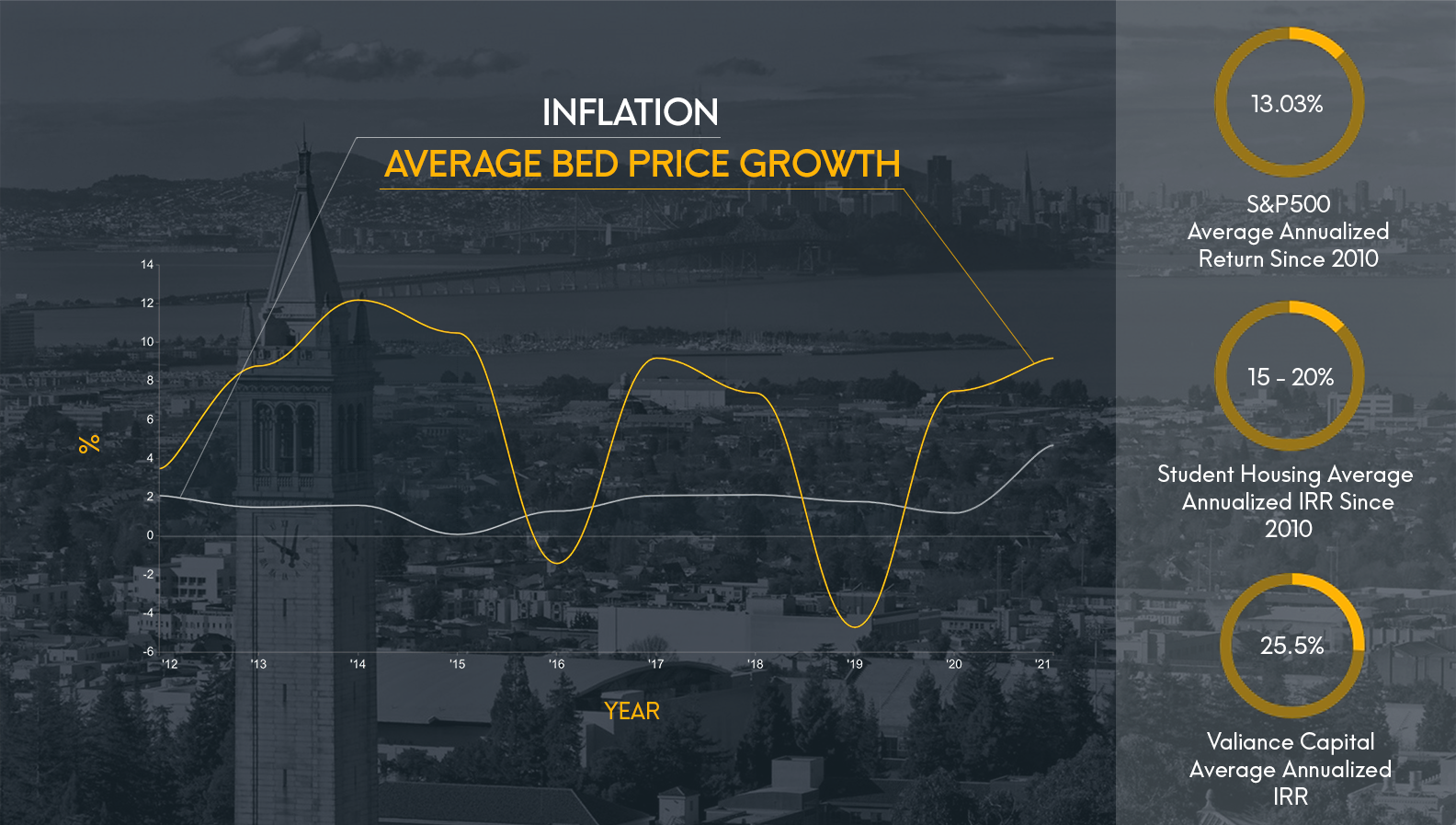

California is already one of the most expensive states in which to rent in the entire nation, and Berkeley not only stays true to this trend, it's leading the way. Between 2012 and 2019, Berkeley saw a 55% rent increase compared to only 26% for downtown San Francisco (all while maintaining a higher than 95% occupancy level).

At the micro level, UC Berkeley student housing saw an average 96.4% occupancy level and rent growth exceeding 75% from 2011 to 2019, confirming an unyielding demand in the face of, what some might consider, exorbitant rent increases. The closer the assets are to campus, the greater the demand, and the greater the rent growth.

EXCEPTIONAL DEMOGRAPHICS

Between 2010 and 2019, the Berkeley submarket experienced an explosion in population growth, rising 10% with a further 5% growth expected by 2026. Berkeley benefits from an affluent, highly educated, youthful and renter focused tenant base with an average household income of $113K, compared to the rest of California at $80K.

The Berkeley submarket has unparalleled access to intellectual capital and talent. Over the past several years, West Berkeley / Emeryville has blossomed into an emerging life science and biotech hub with more than 150 companies in the biotech field and over 200 startups under license from UC Berkeley. It has become a dynamic center for research, discovery, and manufacturing of biotechnology in the Bay Area, driven by UC Berkeley being one of the preeminent research universities in the world.

Core+

Our "Core+" strategy is focused on acquiring pre-lease up, or stabilized but undermanaged, assets to capitalize on historically high vacancy or rent growth potential with minimal capital investment. Select properties that are recently constructed or repositioned by developers will require active asset management in order to unlock their potential. We apply best-in-class property management to implement net operating income growth by maximizing rental rates and ancillary revenue opportunities with rigorous operational controls to manage and reduce expenses.

Value-Add

Our "Value-Add" strategy is focused on acquiring under-managed assets in the nation's most desirable markets and implementing an active asset management approach and focused capital improvement plan to maximize the property's potential.

Unlike our "Core+" strategy, value-add opportunities are characterized by higher vacancy, little to no intermediate-term cash flow and a significant capital investment in physical property improvements and operations. We strategically deploy capital to improve rental units, unit mix, streetscapes, common areas and amenities, among other spaces, in order to achieve proven increases in rental rates and net operating income.

Opportunistic

Our "Opportunistic" strategy is focused on delivering outsized returns through investments in assets or debt instruments with a significant redevelopment or litigation component. Opportunistic investments are characterized by negative to little in-place cash flow and longer lead times to stabilization or realization than our "Core+" and "Value-Add" investments. These opportunities include ground up development, heavy value-add repositionings and investments in non-performing loans with a high degree of third party involvement and complexity. These opportunities also tend to require significant rehabilitation or management in order to realize their potential.

OUR WHY

Our Investors

25.5%

Average Net

Annualized IRR

2.8x

Average Net

Equity Multiple

$70M

Total Investor

Equity Invested

$225M

Assets Under

Management

40

Investment

Executions

200

HNW

Investors

STUDENT HOUSING

Latest Market News

Access the Highest-Quality

Real Estate Investments

Invest Like an Institution

©[current_year] Valiance Capital. All Rights Reserved.

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither Valiance Capital nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision. For our current Regulation A offering(s), no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth (excluding your primary residence, as described in Rule 501(a)(5)(i) of Regulation D). Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Valiance Capital is a privately held real estate development and investment management company with a primary focus on multi-family and student housing properties.

INVEST LIKE AN INSTITUTION

Access the Highest-Quality Real Estate Investments

Valiance Capital LLC

2298 Durant Ave

Berkeley, CA 94704

investors@valiancecap.com

(510) 446-8525

©[current_year] Valiance Capital. All Rights Reserved.